|

||||||||

In Curbing Emissions, Florida Explores Carbon Markets

Last summer, Florida vaulted into the forefront of states taking action on climate change with executive orders mandating steep cuts in greenhouse gas emissions, opening the door to new financial opportunities for stakeholders to profit from a cleaner environment.

Legislation working its way through the Florida Legislature this session includes a provision directing the Florida Department of Environmental Protection to design a “cap-and- trade” program to reduce GHG emissions including carbon dioxide (CO2), the predominant greenhouse gas responsible for global warming.

A state action team on climate change has been tasked with hammering out the details of that program.

The idea behind carbon trading is simple: the quantity of emissions is fixed or “capped” at a certain level and the right to emit becomes a tradable commodity. Participants able to reduce emissions below the cap earn credits that they can then sell to those for whom compliance costs are higher. In that way, the system rewards those who reduce pollution while lowering overall compliance costs by achieving reductions at the most cost-efficient point.

The details are far more complex. Among the considerations:

- The sources and sectors to which it would apply

- Where caps will be set and how allowances would be distributed

- Incentives for early adopters

- How to address “leakage,” or the potential for GHG increases outside the state as a result of stricter in-state policies

- And the potential of linking Florida’s carbon market with other regional, national or global carbon markets.

Governor Charlie Crist has called for reducing GHG emissions by 80% of 1990 levels by 2050 with intermediary targets at 2017 and 2025.

With nearly 1200 miles of coastline and the majority of residents living in coastal communities, Florida’s vulnerability to rising seas and violent weather has made state efforts to address climate change a leading priority.

“Reducing worldwide emissions of greenhouse gases is imperative to combat the effects of climate change,” says Stephen Adams, Director of Strategic Projects and Planning for DEP and a member of the climate change action team. “We believe that market-driven approaches like cap and trade are the best way to accomplish this task.”

Florida currently ranks sixth among states in total GHG emissions and 30th among the world’s top 75 emitters among states and nations.

As a first step in developing a climate change action plan, DEP is producing a comprehensive GHG emissions inventory of sources and “sinks” or activities that have the capacity to absorb or offset carbon emissions. Coal-fired power plants and fossil-fuel combustion from mobile sources such as cars and trucks are the largest contributors. Forests and some no-till or seasonal tillage agricultural practices act as sinks.

As a first step in developing a climate change action plan, DEP is producing a comprehensive GHG emissions inventory of sources and “sinks” or activities that have the capacity to absorb or offset carbon emissions. Coal-fired power plants and fossil-fuel combustion from mobile sources such as cars and trucks are the largest contributors. Forests and some no-till or seasonal tillage agricultural practices act as sinks.

The most developed example of a GHG cap-and-trade system in the U.S. today is the Regional Greenhouse Gas Initiative (RGGI), a cooperative effort of nine New England and Mid-Atlantic states to reduce CO2 emissions from power plants in the region launched in 2003. The agreement calls for signatory states to stabilize power plant emissions over the first six years of the program (2009-2014) to levels roughly equivalent to current emissions, before initiating cuts of 2.5% per year from 2015 through 2018. The approach will produce an overall reduction of 10% over the initial regional cap, which is roughly 4% above annual average emissions for 2000 through 2004.

Whether Florida’s carbon trading program will revolve solely around utilities or include other sectors is uncertain at this point. Another unknown is whether and how Florida might link its program to other regional initiatives such as the RGGI.

“This is part of what the action team’s technical workgroup will be evaluating – whether it is cost-effective and economically feasible for there to be a Florida-only program, or whether it would be better for Florida to join one of the programs already under development,” says Adams.

Sources say a federal cap-and-trade program within the next five years is almost certain, regardless of the outcome of November elections. “It’s a smart move for Florida to prepare itself for federal mandates by putting something together at the state-level early,” says Sarasota businessman John Burges of Pretium LLC, who has invested in energy projects worldwide.

Allocations Pose Questions

One of the biggest debates may revolve around the allocation of credits under a state cap-and-trade program. One option is for Florida to auction emission allowances, which could raise sizeable revenues that lawmakers could use to reduce the impact on consumers or reinvest to support development of renewable energies. Alternatively, free allocation is designed to compensate shareholders of affected companies for any declines in stock values they might experience in meeting the cap.

Such provisions have long been standard in U.S. cap-and-trade programs to limit sulfur dioxide emissions causing acid rain and in the European Union’s Emissions Trading Scheme, although the EU is considering changes to its program to favor auctioning.

According to the Congressional Budget Office, evidence indicates that only a small fraction of the CO2 allowances would be needed to provide such compensation under a U.S. cap-and-trade program. Researchers generally conclude that less than 15% of allowance values would be necessary to offset net losses in stock values for both “upstream” industries (such as suppliers of coal, natural gas and petroleum) and energy-intensive “downstream” industries (including electricity generators, petroleum refineries and metal and machinery manufacturers). That’s because the cost of holding the allowances would largely be reflected in the prices that producers charge, regardless of whether they had to buy the allowances or received them for free.

According to the Congressional Budget Office, evidence indicates that only a small fraction of the CO2 allowances would be needed to provide such compensation under a U.S. cap-and-trade program. Researchers generally conclude that less than 15% of allowance values would be necessary to offset net losses in stock values for both “upstream” industries (such as suppliers of coal, natural gas and petroleum) and energy-intensive “downstream” industries (including electricity generators, petroleum refineries and metal and machinery manufacturers). That’s because the cost of holding the allowances would largely be reflected in the prices that producers charge, regardless of whether they had to buy the allowances or received them for free.

One of the common misconceptions is that free distribution of allowances to producers will prevent energy prices from rising. While producers do not incur out-of-pocket expenses for allowances, using those allowances creates an “opportunity cost” because it means foregoing income they would earn by selling the allowance. Those costs are typically passed on to consumers in much the same way as actual expenses.

The result, borne out in cap-and-trade programs for sulfur dioxide in the U.S. and for CO2 in Europe, has been an increase in consumer prices even though utilities were given allowances for free.

Thus, giving away allowances could produce windfall profits for participants that receive them by effectively transferring income from consumers to companies and their shareholders.

Worse still, says Burges, it can also result in unintended consequences. “In Europe, they basically gave out allowances for free to coal power plants or at so low a price that it actually made it more attractive to run some coal plants harder rather than switching to cleaner natural gas.”

It’s absolutely critical that we look at and understand what an owner’s motivations will be under allocation pricing and incentivize them to use cleaner energy,” he says.

Financial Opportunities Abound

As Florida works out the details of its program, one thing is certain: carbon markets present huge financial opportunities. In 2007, carbon credits estimated at $70 billion changed hands, and the figure is growing steadily.

Meanwhile, rising energy costs are pushing many businesses to take a hard look at incorporating energy management into their business plans. “We’re seeing increased levels of investment in energy efficiency and energy conservation within the commercial and industrial sectors,” says Adams.

The state has upped its investments as well. In just the last two years, Florida has pumped more than $50 million into grants for renewable and alternative energy projects. And these sectors aren’t the only ones poised to benefit from carbon trading. New opportunities are likely to arise for farmers and forestry interests to offset carbon emissions by planting trees and “cropping” or storing carbon in soils, as well as producing biomass fuel to meet Florida’s energy needs.

The state has upped its investments as well. In just the last two years, Florida has pumped more than $50 million into grants for renewable and alternative energy projects. And these sectors aren’t the only ones poised to benefit from carbon trading. New opportunities are likely to arise for farmers and forestry interests to offset carbon emissions by planting trees and “cropping” or storing carbon in soils, as well as producing biomass fuel to meet Florida’s energy needs.

While it’s too soon to tell, Florida could become a hub for a market that might develop with Central and South America. In the near term, the Florida Legislature is considering a bill that would require ethanol blending for most grades of gasoline sold in the state by 2010. “This requirement could spur further economic activity within the pan-Caribbean area as ethanol derived from sugar cane may prove to be a lower-carbon alternative to conventional corn-based ethanol produced largely in the Midwestern United States,” says Adams.

“If we make Florida a hub for developing international carbon trade, we’ll be able to energize Florida’s economy,” said Florida Chief Financial Officer Alex Sink in a recent address at an Emerging Carbon Markets Conferences in Miami. “We have to change the way we do business and explore what opportunities clean energy offers to Floridians.”

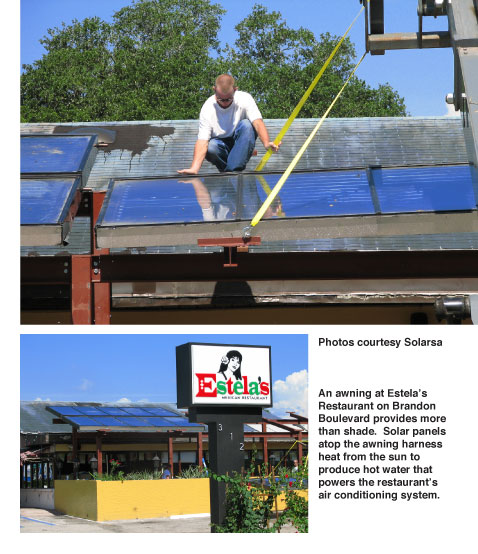

Powered by the Sun: Estela’s Goes Solar

Scott Jorgensen has seen the light and he’s busy putting it to work at his Brandon restaurant.

Scott Jorgensen has seen the light and he’s busy putting it to work at his Brandon restaurant.

At Estela’s on Highway 60, Jorgensen is putting the finishing touches on a solar-powered air conditioning system that will take a substantial bite out of his restaurant’s electric bill while slashing demand for electricity at peak times of the day when other businesses are gorging themselves at the power trough.

“It’s not just about saving energy, it’s also about saving energy at the right time,” Jorgensen says.

When the system comes online, Jorgensen expects to shave $1000 a month off a monthly electric tab of about $1500, and slash another $300 to $500 from his monthly gas bill for heating water. He’s invested about $300,000 in solar technology, which with the help of federal tax credits should pay for itself in about 12 years, he estimates.

On days when the sunlight isn’t sufficient, the system will use waste cooking oil as a backup energy source. The restaurant currently has its waste oil hauled away.

Patios covered by outdoor awnings outfitted with solar panels are already creating quite a buzz among patrons. “Customers love it,” says Jorgensen, who has seen restaurant sales jump 10% even as most other restaurants are experiencing a slowdown. He and his wife Estela also own three other restaurants.

Still, it wasn’t economics that steered them to pursue alternative energy. For Jorgensen, the wake-up call came on September 11, 2001. He got to thinking about how he could help fight the war on terror. “I have young children and I don’t want my children fighting for oil,” says Jorgensen, whose restaurants serve large numbers of military personnel.

What he could do, he decided, was use less oil. “I’m just one person making a statement, trying to take responsibility for what’s going on,” he says.

Making the leap to solar wasn’t easy. Research led him down the path of solar thermal cooling. But finding ready-to-use technology scalable to his restaurant was all but impossible from domestic vendors. Europe and Japan were years ahead. One company even told Jorgensen he was living in the wrong country. “The challenges I went through were ridiculous,” Jorgensen recalls. “When I saw that it wasn’t available, that’s when I got the idea for a business.”

Jorgensen formed Solarsa to bring the technology to market in the U.S. The start-up company is a distributor for manufacturers offering a combination of solar hot water, solar electricity and solar cooling products. The company is already working on some of the largest onsite solar thermal systems in North America and hopes to land a state grant that will allow it to build a manufacturing and distribution plant near Tampa.

“The days of having low-cost subsidized fuels are over,” says Jorgensen. “As the price of fuel soars, renewable energies are going to play a much larger role in our society.”

| Flexible, Light and Cheap, Solar Panels Hit the Printing Presses Imagine boats running on solar electricity that powers a cheap electric engine. Or replacing your roof with solar panels printed on flexible foil materials at the job site. Ground-breaking advances in solar panel technology are paving the way toward a future that just a few years ago might have been considered science fiction. While the mass commercialization of such technology is still years away, new thin-film solar panels rolling off assembly lines now are poised to revolutionize the market, ushering in a much wider range of applications than ever before possible. Fueling the breakthrough are specialized ink-jet printers that spew nano particles of semi-conductor ink onto rolls of thin, flexible foils. Thin-film solar cells – based on stacks of layers that are 100 times thinner than silicon wafers but just as powerful – are nothing new. They arrived on the market 10 years ago, but have been handicapped by two issues: speed and cost. The cell’s semi-conductor was deposited onto glass using vacuum-based processes that were slow and expensive. Now, companies are creating spray-on films that can be printed on flexible foil material using machines that look like giant newspaper presses. Recent advances will mean solar factories can churn out panels for a fraction of the cost of earlier generations by printing thin-film photovoltaic cells onto conductive surfaces such as metal foil. Companies are jockeying for dominance in this new market. The leader appears to be Nanosolar, a Palo Alto-based company that has attracted $100 million in venture capital investment from Google founders and other well-known Silicon Valley luminaries. It shipped its first flexible thin-solar panels in December to be deployed at a 1-megawatt solar power station in Eastern Germany. The release is significant because the company has developed a process to print solar cells made out of CIGS, or copper indium gallium selenide, a combination of elements that many companies are pursuing as an alternative to silicon. Even more stunning is the price: Nanosolar claims its solar panels can be produced for as little as $1 per watt, which would make it competitive with electricity produced from fossil fuels. By dramatically speeding up the manufacturing process and slashing production costs, new thin-film panels have boundless applications. Working with PowerFilm, the U.S. Army is testing prototypes for an emergency tent that delivers a kilowatt of energy, enough to run a computer, refrigerator, radio, water purifier and lights. Solatec has devised a flexible solar panel add-on for the rooftop of the Toyota Prius that would increase mileage by an additional two miles per gallon. |