[su_pullquote align=’right’][/su_pullquote]

Most people don’t think about flooding until there’s a big storm heading their way, but Pinellas County residents will save more than $5 million this year on their flood insurance premiums because its floodplain management team has earned a great rating for its proactive flood risk reduction program.

Lisa Foster, who heads the team, was awarded the 2018 national award of excellence for outstanding leadership from the Federal Insurance and Mitigation Association, a division of the Federal Emergency Management Agency. Pinellas County participates in the Community Rating System (CRS), a voluntary program that encourages floodplain management activities that exceed minimum requirements — and then rewards communities with flood insurance rate discounts for implementing activities to help prevent negative impacts from flooding prior to a flooding event.

“Everybody lives in a flood zone – which one depends on the level of flood risk to your home,” Foster said. “Our goal is to minimize the risk of flood damage for everyone who lives here.”

The county has a series of diverse programs that earn CRS points, she adds.

One of the most important components to mitigating flooding is the percentage of open lands in Pinellas that capture rainwater, reducing stormwater runoff that may potentially cause damage to homes and other structures. Another is the county’s above-standard maintenance program for storm drains and ditches, as well as its highly rated emergency notification service and its regulations on new development in floodplains.

Among the most visible year-round efforts are outreach programs aimed at realtors as well as people who live in high-risk areas, Foster said. “We work very closely with realtors, giving them the tools they need to explain the risk.”

County staffers also reach out to residents in high-risk areas to explain how floodplains work and how they can help prevent damage before it happens. In some cases, like the area near McKay Creek, the county has purchased homes that flooded repetitively. That creates a two-fold benefit: first allowing the properties to serve their function as a floodplain during flooding events and then providing recreational opportunities for nearby residents.

“Lisa’s work has saved more than $5 million on an annual basis for flood-insured county residents and businesses,” said Rahim Harji, assistant county administrator. “She believes so strongly in helping people understand their flood potential and getting out the word about purchasing flood insurance to protect families and businesses from financial hardship.”

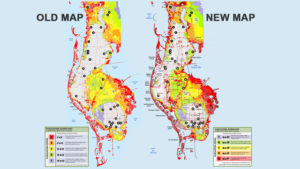

Flood hazard areas are identified by determining the chance that the area that will be inundated by the flood event having a 1% chance of flooding in any given year. That annual chance has also been refered to as the 100-year flood zone. Within that area, zones are broken down by the potential for flooding. Moderate flood hazard areas — labeled B — are considered within the 500-year floodplain and areas not expected to flood are Zone X.

Being better prepared for flooding events will be one of the priorities for the newly formed Tampa Bay Regional Resiliency Coalition, adds Heather Young, principal environmental planner for the Tampa Bay Regional Planning Council. “As a region, we need to work together to reduce long-term impacts. The combination of sea level rise and rainfall intensity, may lead to more frequent localized flooding. The work being done by Pinellas County has impacts beyond educating the public regarding flood risks, every dollar saved by local residents on their insurance premiums is a dollar that remains in the local economy.”

Know the Risks & How to Prevent Them

- Check out the latest floodplain maps in your county — search for your county and floodplain map. Local counties allow you to enter your address and determine your risk.

- Considering getting flood insurance even if your mortgage company does not require it. Standard homeowner’s policies don’t cover flooding – but up to 80% of the homes that flooded in Hurricane Harvey did not have coverage. (Take advantage of a highly discounted preferred risk rate policy if you are in a low- or moderate-risk flood zone.)

- Elevate high-value equipment, such as water heaters, generators and AC units.

- Install check valves to prevent sewage from backing up into your house.

- Make sure storm drains are open and empty of debris. Leaves and lawn debris can clog the surface of storm drains or pipes, leading to local flooding issues.

- If your home floods once, consider options such as using moisture- and mold-resistant drywall and raising electrical outlets above the flood elevation so they won’t need replacement if the house floods again.